Letter #31 – ✍️ Writing in San Francisco 🌉🌁

This week’s newsletter:

Our Investment Budget Cut ✂️💰

Mega Backdoor ROTH 🚪: The 1-Minute Guide

Before we get to the serious money topic...

We took three forest strolls this weekend. 💚

Nature is our free therapist now. 😌 With all the rain comes lush green and that wonderful wet soil scent. Ahhh, and the pine trees 🌲 are as soothing as can be.

So hope you also had a peaceful, restful weekend. Discover what helps you live with ease and invest more time in it. 🤎

“The only time I see you stress is when you're working on the budgets."

–Tyler would tell Angie that whenever he caught her giving the laptop a very serious look. 💻😩

It wasn't stress. Angie was just SO confused 🙉 these past 2 months reviewing the budgets.

Why did it seem like we suddenly didn't have enough money to allocate??

Was it because we’d carefully budgeted for our upcoming trips? (Last year our budgets blew up a few times💥 not a fun surprise).

Or had our lifestyle quietly crept upward? 🙊 Why why why???

Then... she realized:💡

We were tight on cash because we forgot 20% of Angie's paycheck already goes to max her Mega Backdoor Roth by EOY. Adding 60% more from take-home meant investing 80% total. 🐒

We've now dropped investment budget from 60% to 40% of whatever hits our bank account so we can actually live life. 😩

Mystery solved. 😮💨 Now Angie can breath.

Though Angie might someday pay to treat the wrinkles between her eyebrows caused by budget-crunching sessions, 💸 she still firmly believes it would be incredibly hard to build wealth and enjoy life without a budget system. 🤌

So set up your budgets and stop asking yourself, "Where did the money go?" or "Why am I constantly stressed about money?"

Read more about budgeting:

The 2025 mega backdoor Roth contribution limit is $70,000 for individuals under 50 and $77,500 for those 50 and older. This limit includes all contributions to a 401(k), including employer contributions, employee deferrals, and after-tax contributions.

Let's say you've maxed out your traditional/Roth 401k (2025 limit: $23,500)

Your employer matches your contributions up to $5,000

Total is $28,500 (= $5,000 + $23,500)

If the limit is $70,000, you can still contribute $41,500 more to your 401k!

So how do you do that? Here comes the magic backdoor 🚪🧚♀️

Check if yours does before getting too excited! Contact your 401(k) plan administrator and go through this script:

Does our plan allow after-tax contributions beyond the standard limit?

Does our plan offer in-plan Roth conversions OR in-service distributions?

What's the process to set this up, and what percentage of my paycheck can I contribute as after-tax funds?

💰 First, make sure you've maxed out, or are on your way to max out, your pre-tax/Roth contributions to your 401(k) (2025 limit: $23,500)

☎️ Call your plan folks and say the magic words: "I'd like to set up after-tax contributions."This call usually takes less than 5 minutes! Just ask about plan eligibility (mentioned above) in the same quick call.And you only need to do it once in your life (…until you change your job). So don't delay it! 🫵

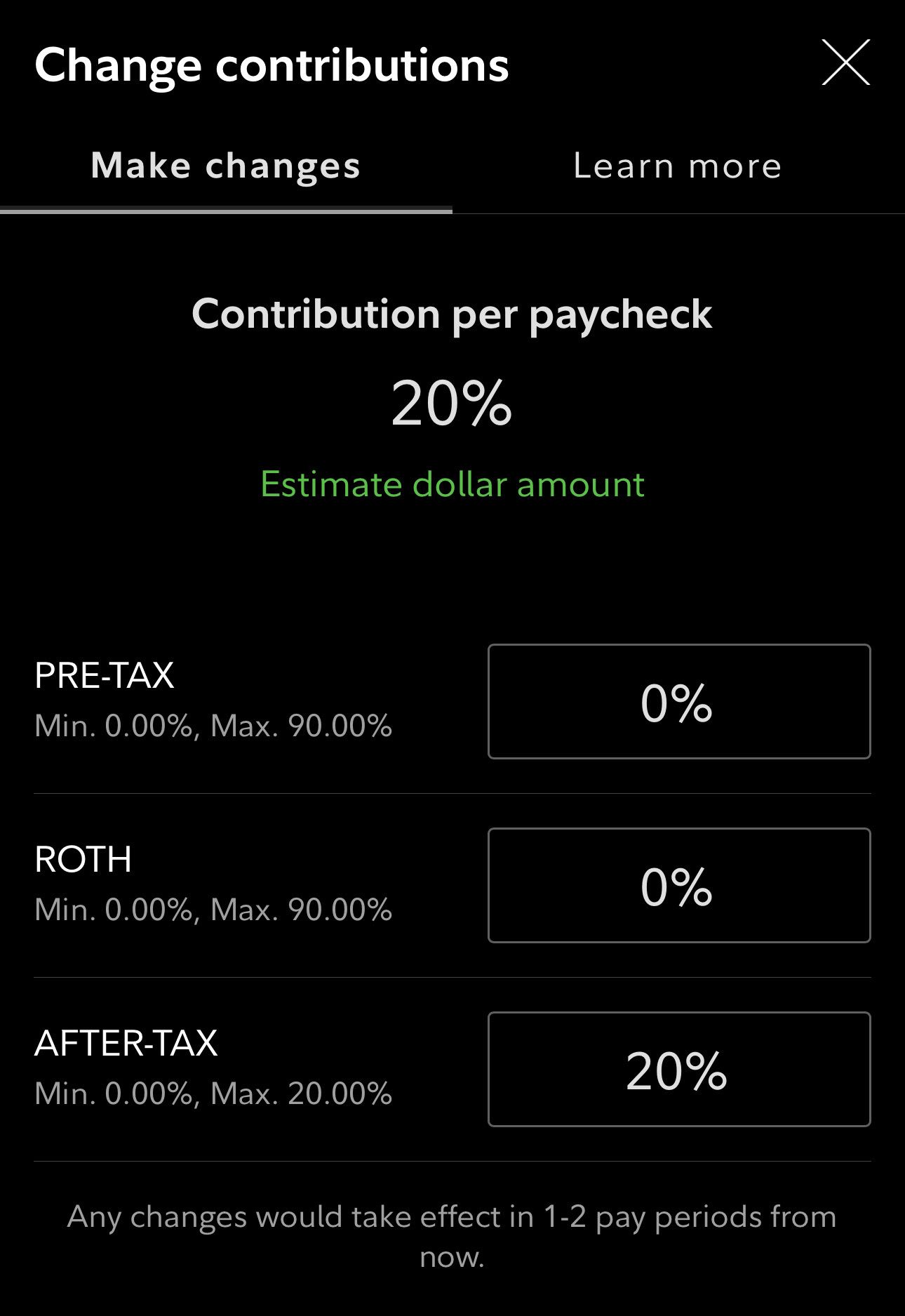

📈 Set your after-tax dollar contributions up to the limit (Angie's employer allows up to 20% per paycheck).

🍹 Sit back and relax. Your after-tax contributions will automatically convert to Roth status!

How Angie set her after-tax contributions on Fidelity NetBenefits app. Make sure to set it to the % you're comfortable with.

Turbocharges 🚀 your retirement savings like strapping a rocket to your piggy bank.

All that growth? Completely TAX-FREE when you retire! (Future you says thanksss.) 🙏

There are two big financial areas you should focus on to make the most out of your money: rent/mortgage and tax!

No income limits—even if you're rolling in dough, you can still do this.

Your money breaks free after 5 years—converted principal is yours penalty-free.

So if you can temporarily part with your money for 5 years, prioritize investing through this method before using a standard brokerage account.

Conversions can trigger tax consequences in the year of conversion.

You may need to fill out Form 8606, Nondeductible IRAs, when filing your taxes for the year.

Again, don’t try to max out everything and get constantly stressed about money. Protect your present time first then add a bit of care to your future self. 😘

Hope it's helpful for your journey to Freedom 🙏

Love you to freedom and back, 🫰

Angie & Tyler

🫙 Current fav jam: We told our friends and family about this amazing jam brand we recently discovered. It usually took us months to finish a jar of jam, but we're on our fourth jar in just a month. It's not ridiculously priced like something you'd find at a Farmers Market. Not too sweet and the flavors are addictive!

⏰ Life-changer alarm clock: We found this gem at a consignment store with an 80% discount. 🤑 Been using it for a few days and omg… it's improved how we feel when waking up drastically. The clock is an analog alarm that wakes you with rotating compositions by Jon Natchez (The War on Drugs' ambient artist) and features Swiss precision engineering.

Personal Finance 💵

Airbnb & VRBO hosting 🏘️

Travel 🧳✈️

Free • 5-min read

Our hard-earned lessons on financial freedom, Airbnb hosting, and living your best life. 🐶⚾️

The tea is ready to spill. 💦

Let’s stroll to Freedom together!

No fluff. Good vibes and honesty Only 🙏🏼