Letter #28 – ✍️ Writing in Seattle 🌲

This week’s newsletter:

Finally at home

The Secret Weapon to Supercharge Investments with Multi Tax Benefits

What it is

Why & when you should use it

All the things to consider

How to

Angie’s second painting

Our city always feels like home, 🥹 but not so much the houses we’ve lived in.

They feel cozy and comfortable. But with the constant traveling and Airbnb-ing, they haven’t exactly felt like… “home.”

This time back, though, we’ve made some major lifestyle adjustments. 💪 Stay tuned for the details, but now every morning brings a deep gratitude—“Whoa… it’s just so nice to be home.” 🥹

This renewed sense of home has sparked Angie’s creativity—she’s back to painting, 🎨 watching IKEA house hack videos, and even cracking open cookbooks. 👩🏻🍳

Meanwhile, Tyler’s been delighted by incidental chats with our neighbors, and strolls around the neighborhood.🚶🏼 He’s also motivated to keep our home decluttered (if you know Tyler, you know it’s a magical transformation). 🤭

Freedom has also brought calm. Just last Saturday, Angie fully enjoyed a one-day online retreat 🧘🏻♀️ despite the usual thousand distractions at home.

The nice thing about strolling toward Freedom is that we don’t have to wait until the end to unlock its gate—we gain a bit more freedom every step of the way. ✨

But how do we know we’re progressing? Our success metric is those moments of ease. 😌

We've been enjoying our time at home with so much contentment and ease. 🩵

May we cherish our day-to-day life just as much as special events. 🙏

Also…

Talking about Angie getting back into painting, she shared her second piece with a friend—and got this feedback. 🙊

So, Angie went back to her art board and spent a few more hours refining her work. Check out the final result at the end of this blog. 👇

We always wonder did whoever came up with names like 401k, IRA and HSA want to keep these powerful accounts a secret? 🤨

At her first corporate job, Angie tuned out the minute she heard those terms.

Don’t be like Angie. 🙅🏻♀️

If you haven’t been paying attention to the amazing Health Savings Accounts (HSAs), it’s time to tune in. 👀👂

An HSA is a special account that lets you save for healthcare costs if you have a high-deductible health plan (HDHP).

It does more than just cover health costs—it’s a killer investment tool. 😎

Here’s where the HSA really shines—it gives you triple tax benefits.

Tax-Deductible Contributions: Just like a 401(k), your pre-tax contributions lower your taxable income.

Tax-Free Growth: Watch your money grow without any tax drag.

Tax-Free Withdrawals: Spend on healthcare anytime without paying taxes—seriously, anytime!

That’s A LOT of tax advantages. It's like having a retirement account on steroids.

High-Yield Savings Account (4%)Your money grows to about $4,440.

Traditional 401(k) (10% return):Your $3,000 becomes roughly $7,780 before taxes, and after paying about 12% tax on withdrawals, you'll net ~$6,840. (it also lowers your taxable income the year of contribution)

Roth 401(k) (10% return)After paying 18% tax upfront (leaving you with $2,460), that amount grows to ~$6,380 tax-free.

HSA (10% return)Your $3,000 grows to ~$7,780—and you can withdraw it tax-FREE for medical expenses.

We haven’t factored in inflation, but you get the idea.

Saving is an awesome financial habit, but it does NOT make you rich. Inflation will make sure of that. ☠️💸

Investing does. 💰 So save, but also invest. And invest in tax-advantaged accounts FIRST, please. 😘

✅ Max out your 401(k) employer match✅ Set up an emergency fund (3–6 months of expenses; not required but highly recommended)✅ Pay off credit card and other high-interest debts (unless the rate is below 7%)✅ Max out your IRA (or Roth IRA)✅ Max out your 401(k)

Thennnnnn you’re ready to contribute to your HSA! 🎉

Eligibility: Make sure your company offers a high-deductible health plan (HDHP). And if you’re eligible for Family Coverage, totally take advantage of that.

Health Factor: You and your dependents should be relatively healthy—or at least able to tolerate the deductible limit (it’s called high deductible for a reason!).

Receipts: Keep all your medical receipts 🧾, you might be able to reimburse them later. No expiration! 📝 Side note:We’re not too worried about keeping the receipts cause our medical expenses will grow with our age, or even faster. We’re in our 30s and already feel our bodies are starting to crumple down. 👴🏻👵🏻 So there’s no shortage of reasons to use those HSA funds.

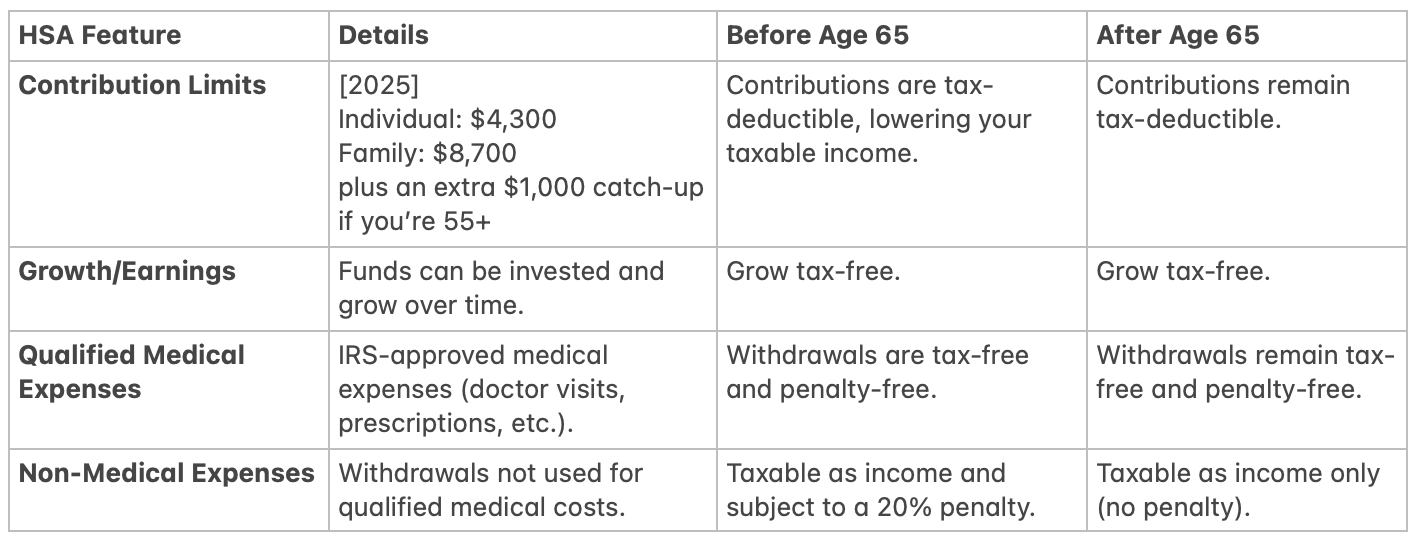

Before and after age 65

Medical vs. Non-medical expenses

No worries, here’s a cheat sheet. 🧚♀️

Many HSAs allow you to invest in stocks, bonds, and mutual funds, so you’re basically turning your HSA into a mini retirement fund.

So the longer you can swallow up those expenses out of pocket, the more growth for your investments.

Chat with HR: Check if your company offers an HSA with investment options.

Keep a Minimum: Most HSAs require you to maintain a minimum balance (ours is $1,000).

Auto-Invest: Set it up so any funds above that minimum automatically get invested.

Pick Your Investments: We usually go for index funds—our top picks!

If you want to keep more of your hard-earned cash, grow it with tax-free gains, and be ready for medical expenses (or even a cozy retirement), an HSA is your secret weapon. 🤫 Embrace those triple tax benefits and watch your wealth blossom! 🌸

OK now back to painting 🖼️

And here it is—Angie’s second piece! ☺️

Moral of the story? Never trust your husband's opinion—they’re way too loving for honest feedback. 🤣

OK the real lesson. Don’t be afraid to fail or mess up in the creative process—there’s no pressure, no expectations, just fun.

Thanks for all the support and advice! Angie’s ready to keep painting (and messing up) even more. 🙇🏻♀️🎨

Hope it's helpful for your journey to Freedom 🙏

Love you to freedom and back, 🫰

Angie & Tyler

A novel about ancient Greece: Whenever Angie steps into a new genre, it’s the writing that hooks her within the first few pages. Last year, it was Tomorrow, and Tomorrow, and Tomorrow. This year? This novel—she's devouring it!If names like Helen of Troy, Sparta, Achilles, Odysseus, or Clytemnestra spark your curiosity, give it a read!

Best Murder Mystery/Psychological Thriller of 2025: Now, onto Angie’s favorite genre! With so many strong contenders, choosing just one is tough—but this book was the undeniable winner last year. 👏🔪📖

Personal Finance 💵

Airbnb & VRBO hosting 🏘️

Travel 🧳✈️

Free • 5-min read

Our hard-earned lessons on financial freedom, Airbnb hosting, and living your best life. 🐶⚾️

The tea is ready to spill. 💦

Let’s stroll to Freedom together!

No fluff. Good vibes and honesty Only 🙏🏼