Letter #1 – ✍️ Writing from Angie’s sister’s kitchen in Philadelphia, PA

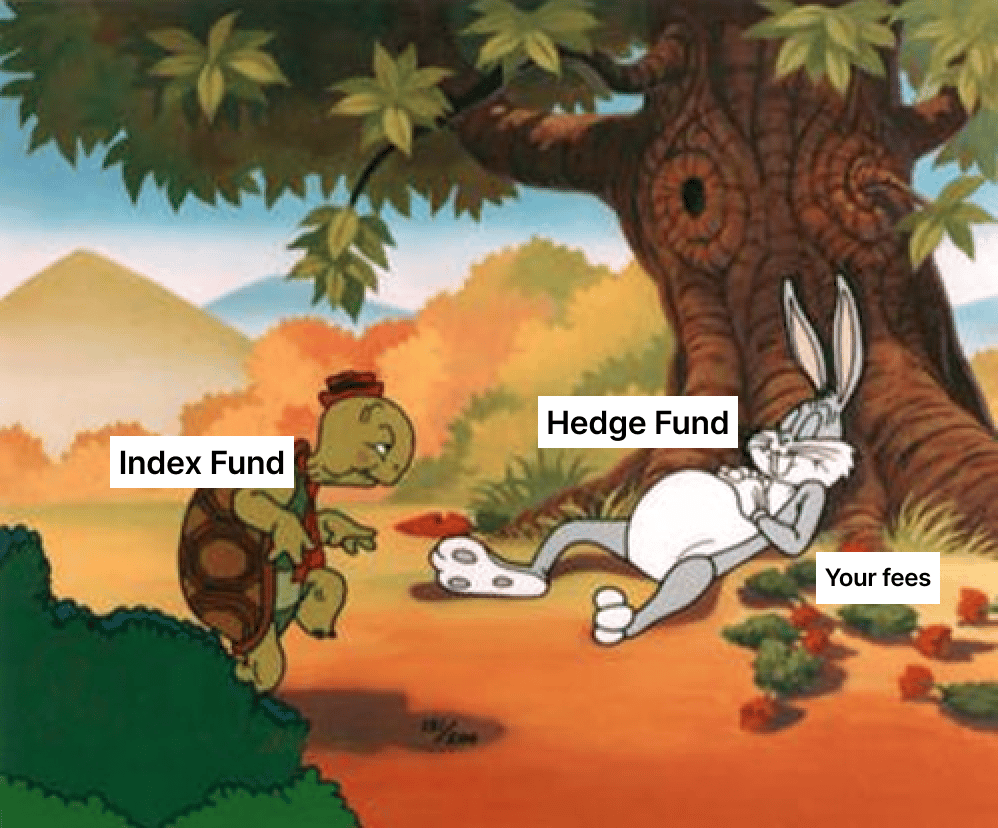

Back in 2007, there was ONE MILLION DOLLARS up for grabs in the ultimate showdown: hedge fund vs. humble index fund.

Enter Warren Buffett (yes, that Warren Buffett 😛), who threw down the gauntlet. 🫡 He bet that no hedge fund could outshine a basic S&P 500 index fund over ten years. (What’s an S&P 500? A way to own a slice of the 500 biggest U.S. companies all in one go!)

If anyone proved him wrong, they’d walk away with ONE MILLION DOLLARS. 🤑 Ted Seides, a hedge fund pro, took the challenge.

Fast forward 10 years and we had the cumulative returns 🥁

Hedge fund: 22%

Index fund: 85.4% 🏆

To add insult to injury, hedge funds charged high management fees and took 20% of the profits, while a simple index fund from Vanguard or Fidelity had super low costs. The index fund didn't just win; it crushed it!

Buffett won the bet and donated the $1 million to Girls Inc. of Omaha, a nonprofit dedicated to empowering young women.

“Slow and Steady wins the race.”

Tyler shared that story back in 2019 during our road trip down Highway 101. 🚗 Ever since then, investing in index funds has been the North Star 🌟 of our stock investment strategy.

Trust us, from our experience, no investment is truly passive except for the good ol' set it and forget it index funds. (If anyone says otherwise, label them as shark 🦈)

Freedom to us is less about building wealth and more about freeing our time and mind space to do what we enjoy. 💎

Literally no one, even the smartest nationally renowed hedge fund traders couldn't beat a simple index fund. If they can't, we probably can't either. 🫣 So, let's stop trying to outsmart the market; it’s already giving us solid returns! 💰

Don’t waste your hard-earned money on fancy managed funds or financial advisors. 💸🥲 Their small fees add up over time, eating into your wealth. Studies show that actively managed funds usually underperform compared to low-cost index funds in the long run.

It’s like the opposite of hitting the gym. The less you mess with it, the better your results!

Once in a while, after consuming too much financial advice on social media, Angie would wonder if we should invest in other stocks. 😅 "What about other ETFs? What about NVIDIA?"

And the king 🤴🏼 of patience when it comes to stock investment (so patient that he forgot a few crypto investments he made, but that’s another story for another day), Tyler would remind us if we can’t outsmart a hedge fund pro in Wall Street, we should follow the footsteps of Buffett’s victory.

Don’t underestimate the power of compound interest. Keep investing no matter what the market is doing.

Be like Neo in The Matrix 🕶️, calmly dodging the bullets of market chaos.

Remember, patience really pays off. The best-performing investment is often the one you set and forget.

So, buckle up and let the index funds do the heavy lifting while you enjoy the ride to Financial Freedom 🚘🗽! Be like Neo!

That's it for today. Hope it's helpful for your journey to Freedom 🙏

Love you to freedom and back, 🫰

Angie & Tyler

P.S. Let’s spread the love 🫶 If you know someone who could benefit from our tips, feel free to forward this email to them 💌!

Angie is poring over “Why We Sleep: Unlocking the Power of Sleep and Dreams” in an attempt to fix our sleep routine, which has been quite messed up from traveling through so many time zones this year. 😪

🦷 Safer floss—Angie’s sister broke the sad news to us that Oral-B Glide floss contains PFAS (also known as "forever chemicals" due to their persistence in the environment and in the human body)!!! 😬 So we’re switching to a safer and more sustainable floss option. There's something about the texture of this new floss that makes flossing so much more efficient 😳

🎧🤸🏻 Earbuds for workouts—While Tyler is paranoid about Bluetooth devices, Angie got these earbuds on Prime Day. Though her ears are still “breaking in” the new earbuds, she finally can move freely during workouts without the fear of them falling out any moment. 😮💨

✈️ Our Upcoming Trip

We’ll be off to Costa Rica 🇨🇷 with Tyler’s parents! 🥰 One of our top freedom goals is quality time with both sets of parents. We might not be able to reverse aging, but we can fill their days with love and fun!

Personal Finance 💵

Airbnb & VRBO hosting 🏘️

Travel 🧳✈️

Free • 5-min read

Our hard-earned lessons on financial freedom, Airbnb hosting, and living your best life. 🐶⚾️

The tea is ready to spill. 💦

Let’s stroll to Freedom together!

No fluff. Good vibes and honesty Only 🙏🏼