Letter #3 – ✍️ Writing from the airplane on the way to San Francisco 🌁

Continuing with Our Fun Guide to Index Fund Awesomeness 🚀, in this letter, we’ll share:

How we invest in Election Year 🇺🇸🗳️

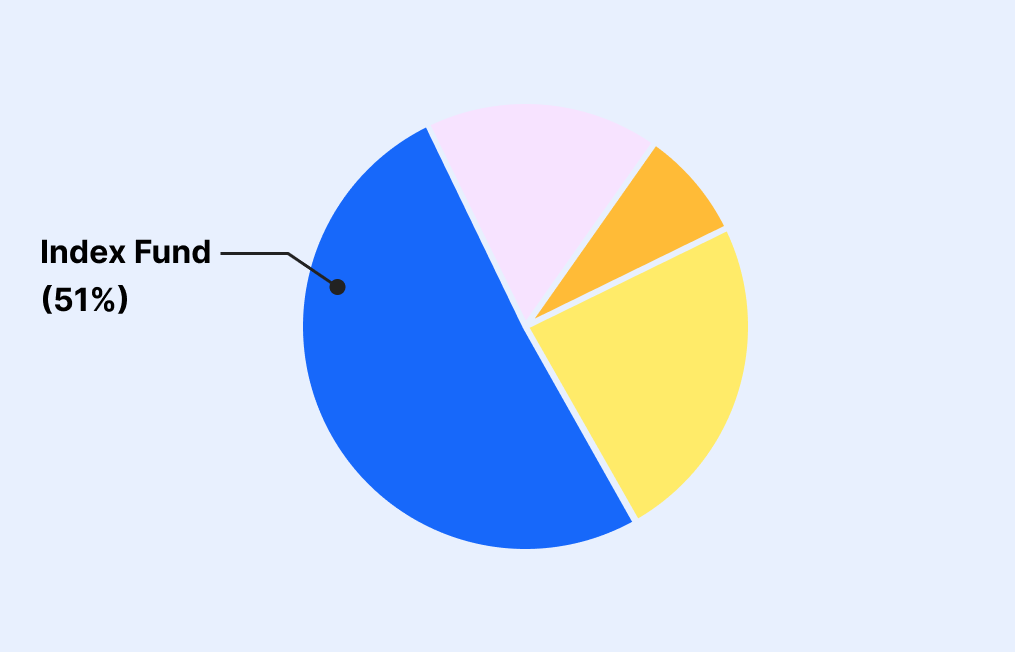

Annnnnnnd the percentage of index funds in our portfolio 🤫

Each presidential election cycle in the USA seems to get more chaotic. 😰 No matter your political stance, it’s hard not to feel the stress. 😩

Our saving grace? Angie has zero interest in politics, so the fact that she’s always been under a rock 🪨 helps our household avoid debates.

Tyler’s plugin army comes in handy during times like this. 🙈 He uses them to block websites and avoid drowning in news.

He’s customized Apple’s Screentime and installed BlockSite. He turns them off after a few days to catch up, then reactivates them to avoid over-consuming the news. (At least that's what he thinks… Angie often catches him exchanging political memes with friends. 👀)

In the end, what matters most are our family, friends, and loved ones. We don’t let politics affect our relationships, keeping our world free of awkward Thanksgiving dinners! 🦃

This approach is similar to investing. Just as we don’t get distracted by the political ups and downs in our personal lives, we don’t let ourselves be swayed or spooked by temporary market volatility, especially during an election year. 📈📉

We’re playing a long game, 🎲 so we keep our gaze fixed on the horizon, not the gravel. Market downturns are opportunities to buy in. 💎

Election years can feel like a roller coaster 🎢 (if you have been monitoring the stock market lately 👀), but don’t let the political drama scare you away from investing.

Here’s how to keep your cool 🥒 and make smart moves with your moolah.

Historically, the S&P 500 averages an 11% return during election years, 😳 slightly higher than the usual 10%.

And for those who wait until after the election, the average return drops to 9%.

So, let’s focus on the facts! 🤓

Dollar Cost Averaging—mentioned in Letter #2—means investing a fixed amount regularly, rain or shine. This method helps you avoid the pitfalls of market timing and keeps you steady through market ups and downs.Remember, index funds need no creativity, just good old consistency. 🤌

Opportunistic Buying: Use market dips to your advantage. History shows that after elections, the stock market often recovers from these dips, making NOW a good time to invest and potentially see significant gains as the market bounces back.

Diversification through Index Funds: Spread your investments across various sectors and even international markets to buffer against domestic political volatility. But when in doubt, go for S&P 500 (SPY, VOO, IVV, FXAIX, VFIAX).

Election years might be wild 🐆, but they also offer great opportunities if you stay informed and strategic. Laser-focus on the big picture and your long-term strategy.

Be like Warren Buffett, the winner 🏆 of the Bet of the Century in Letter #1. Keep calm, invest smart, and let the political waves roll off your back. 🙏

See, we do walk our talk, right? 😉 When we started this newsletter, our top priority was transparency. Financial Freedom isn’t a distant dream, and you don’t have to hustle to the bone for it.

So come join us on this journey, and together we'll stroll towards Financial Freedom.

Next letter 💌, we'll share a step-by-step guide on how to invest in index funds 👨🏻🏫 and reveal which ones we picked. 🤫

That's it for today. Hope it's helpful for your journey to Freedom 🙏

Love you to freedom and back, 🫰

Angie & Tyler

P.S. Let’s spread the love 🫶 If you know someone who could benefit from our tips, feel free to forward this email to them 💌!

Tyler is a dark chocolate 🍫 fanatic, and this Brooklyn-based brand is in his top 3. Angie got it for him on special occasions whenever she ran out of gift ideas. 🤫 Despite growing up in NYC, it took the boy years to give it a try—he couldn't get past the questionable branding. Better late than never, right? 😅

🚽 Travel toilet seat cover—We’re not always blessed with first-world public restroom, so this is for those who can’t squat over a public toilet and wouldn’t want their 🍑 touching the seat. Angie carries this around when traveling like a protective charm 🪬

Personal Finance 💵

Airbnb & VRBO hosting 🏘️

Travel 🧳✈️

Free • 5-min read

Our hard-earned lessons on financial freedom, Airbnb hosting, and living your best life. 🐶⚾️

The tea is ready to spill. 💦

Let’s stroll to Freedom together!

No fluff. Good vibes and honesty Only 🙏🏼