Letter #8 – ✍️ Writing from Seattle 🌲

In this letter 💌, we’ll share:

Financial Freedom on the Go: Travel tips 🤫 to keep your budget in check while strolling to Financial Freedom

Annnnnnd our favorite budget tools for traveling 🥰

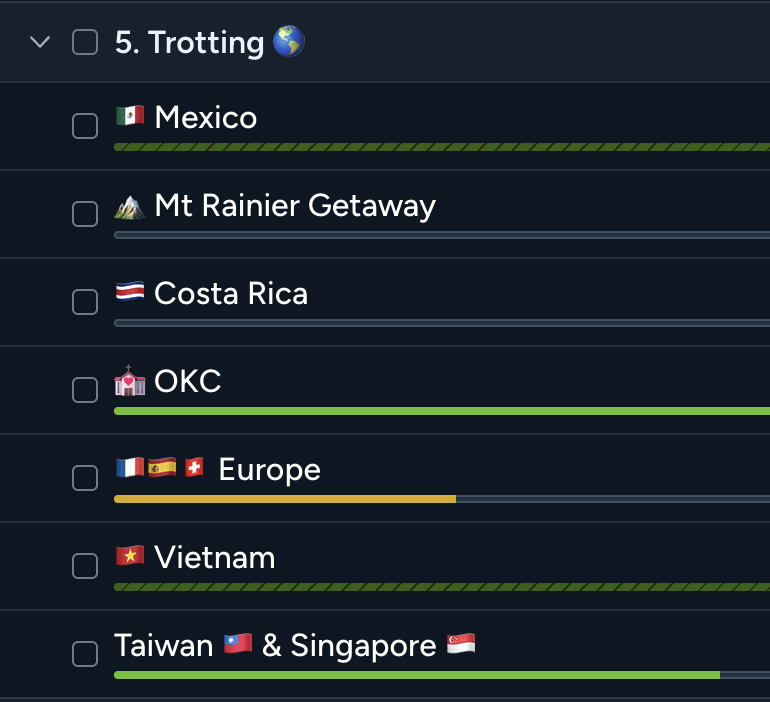

From now until the end of the year, we’ve got 5 trips, 6 countries lined up!

We’re pretty much living with "Rather Be" as our theme song—“There’s no place I’d rather be...” (except, maybe, home 🫠). We swore next year would be our chill year…

Still, we’re incredibly grateful. Not a single moment is taken for granted. 🙏

The path to Freedom we’ve chosen lets us travel like crazy (okay, maybe a bit too crazy this year 😅), and still spend 4 months a year with both sets of parents, and reconnecting with friends across the globe. 💞 Reunions always bring us so much joy.

Now, if we were only hopping on a plane 2-3 times a year, we could afford to be a bit looser with our budget.

But… traveling 6 months a year? 🛫🛬 That’s budgeting on expert mode 🤓 if we’re going to hit Financial Freedom by 2027.

So here’s to balancing wanderlust and saving smart, because the dream doesn’t come without a plan! 🌍💸

and know it won’t derail your path to Financial Freedom. 😎✈️ Living the dream and still playing the long game—who says you can’t have it all?

to minimize how much extra you’ll need to save each month.

Here’s a simple formula:

Travel budget = estimated trip cost – what you'd spend at home.

For example, You're off to Uzbekistan 🇺🇿 for 2 weeks (on our bucket list 🤭).

Monthly home expenses are $4000 (excluding rent/mortgage), and your trip costs $3000.

So, the real extra savings you need is $1000 (= $3000 trip cost - $2000, 2 wks of your home expenses).

And if you book flights 4 months ahead, set aside $250/month—BAMMM, trip paid before takeoff. 💃🕺

Budgeting doesn’t limit you—it frees you up 🎈 to spend confidently, knowing your finances are in check. No more anxiously waiting for post-trip costs to creep up unexpectedly! 😨💸

You’ll have the best time 🤩, all while planning even more adventures. Ain’t that a good feeling? 🌍💰😎

This is just 2/3 of all the trips we’ve taken this year. Imagine if we didn’t have a budget in place?!! 😵💫 Can’t go back to that YOLO life when we had zero visibility into our finances 🙉.

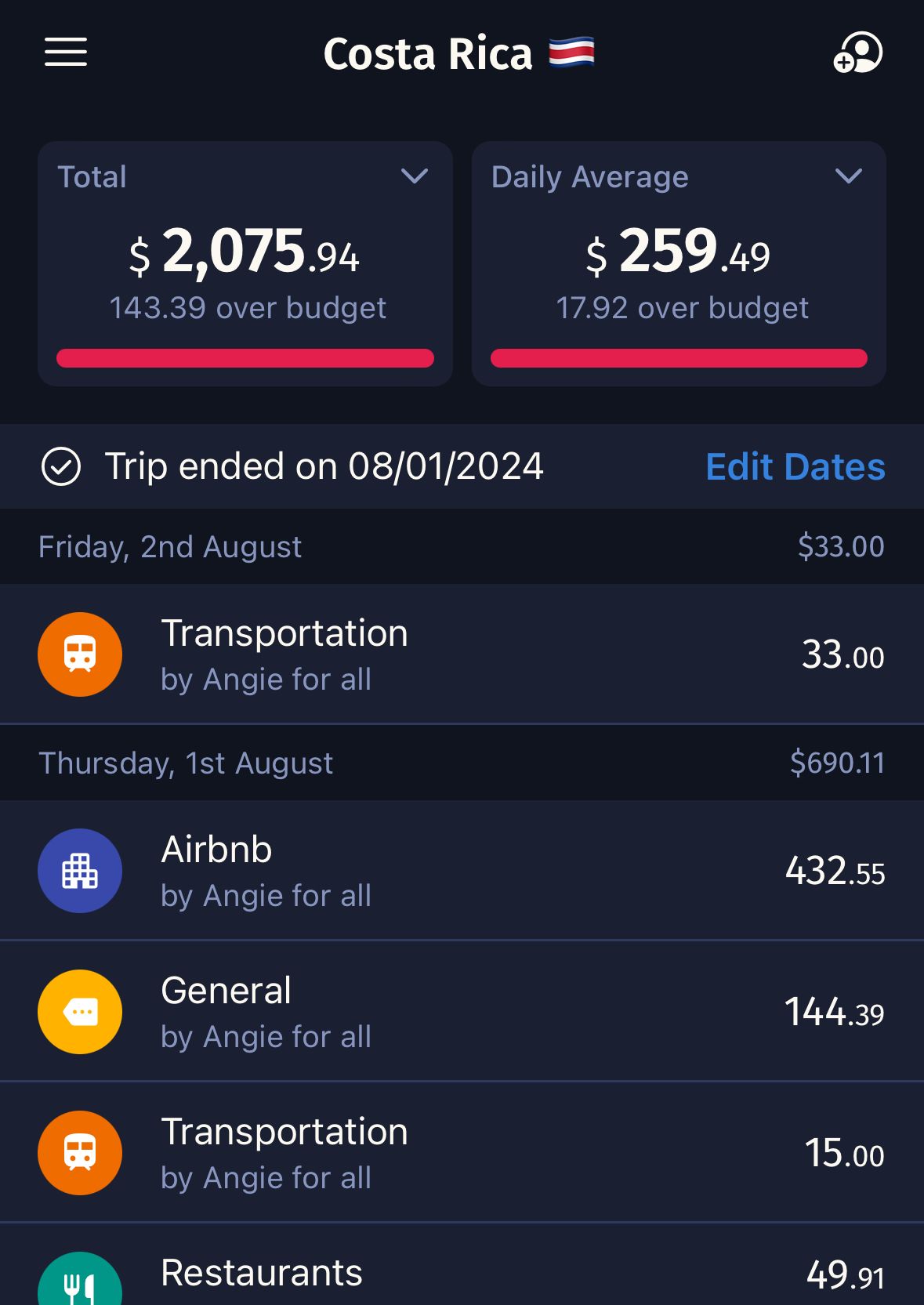

Traveling can quickly make us lose track of how much we’ve spent—cue in this amazing app.

It's your personal financial guardian angel 👼 while you're on the road.

You can track expenses in multiple currencies 🤯 (it does the conversion for you!), and visualize your budget in real time.

Bonus: It works offline, so no chasing Wi-Fi in the jungle.

💫 Pro tip: Manually record every expense immediately—you’ll thank yourself later!

We used the app to track expenses during our Costa Rica trip to (mostly) stay within budget. 👀

When withdrawing cash from ATM or paying abroad, ALWAYS choose the local currency option.

Avoid conversion traps that make your coffee cost as much as a three-course meal.

💫 Pro tip: Carry some cash for small places where card machines are rarer than Wi-Fi.

Nobody likes hidden fees—especially from ATMs.

Our go-to ATM card for traveling reimburses all ATM fees worldwide, so you can access cash anywhere without worrying about extra charges! More savings for snacks.

💫 Pro tip: Set up travel notice (here’s how) before you take off.

Using the right travel credit cards can help you rack up points on flights, hotels, and even everyday expenses.

Redeeming points for flights or upgrades can save you big time and stretch your travel budget even further. We bought 85% of our flights this year with points 🤘

Check out the r/awardtravel and r/churning SubReddits for tips on maximizing travel points.

Just remember, everything in moderation—don’t spend too much time optimizing (Angie went down the rabbit hole for two months before realizing she could've used that time on something more meaningful 😅).

Stick to these tips, and you’ll return home with amazing memories—and a bank account that hasn’t ghosted you.

That's it for today. Happy (and budget-friendly) travels! ✈️🌎💰

Hope it's helpful for your journey to Freedom 🙏

Love you to freedom and back, 🫰

Angie & Tyler

P.S. 1 Don’t forget to splurge a little... but only if it’s truly worth it (hello, spa day!).

P.S. 2 Let’s spread the love 🫶 If you know someone who could benefit from our tips, feel free to forward this email to them 💌!

We got back home a few days ago, which means Angie is back in her meal prep zone. 👩🏻🍳 One of her best tricks? 😏 Freezing chopped garlic/ginger and olive oil in ice cube trays—and rice (yep, you read that right). Not all trays pop the cubes out easily though. Angie’s broken a few, but she finally found the perfect ones for garlic and a separate set for rice.

This candle warmer is a total game-changer! It makes our place smell amazing without the risk of burning down the house. Yo and it extends the life of the candles 🤯 You can keep using your favorite fancy candle (probably from Diptyque) forever! It was even on Google’s gift list last Christmas, so guess we’re not the only ones obsessed. 🤭

Personal Finance 💵

Airbnb & VRBO hosting 🏘️

Travel 🧳✈️

Free • 5-min read

Our hard-earned lessons on financial freedom, Airbnb hosting, and living your best life. 🐶⚾️

The tea is ready to spill. 💦

Let’s stroll to Freedom together!

No fluff. Good vibes and honesty Only 🙏🏼